Can a customer lifetime period more than five years?

The customer lifetime value template provided on this site provides calculations in excess of five years and actually includes potential customer revenues up to 50 years. This may seem an excessive period time, but the customer lifetime value calculation can also be used in business to business markets where long-term supply relationships are indeed possible. And there are also some consumer markets where there could be very long (virtually lifetime) customer relationships – such as, banking, insurance, and even basic products like toothpaste and soap.

However, if you use a discount rate and a customer retention rate in your customer lifetime value calculation, this automatically safeguards against your customer lifetime value number being excessively large. In fact, even at an 80% customer retention rate and a 10% discount rate, the contribution of customer revenues beyond 10 years is quite minimal.

Let’s use an example to explain – which has been calculated using the customer lifetime value template.

- Customer acquisition cost = $1,000

- Profit contribution per customer per year = $1,000 pa

- Retention rate = 80%

- Discount rate = 10%

- Customer lifetime value (CLV) = $2,333

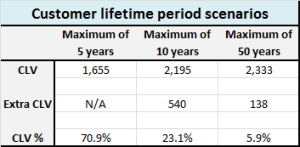

Because of the combined effect of the reducing customer base and the heavier discounting of customer profit contribution over time – the extra contribution of the customer profits beyond the 10 year horizon is $138 or 5.9% in the above equation.

If we only considered a 10 year horizon and assume that there were no customers left at that time – the customer lifetime value above would be $2,195. Likewise, if we only use a five year time horizon and assume that there are no customers of value after the five year point – then the above customer lifetime value calculation would become $1,655.

Let’s combine all of these figures into one table (see below) – and remember this is for 80% retention and 10% discount rate. As you can see over 70% of the customer value is derived in the first five years, with a further 23% of value being delivered in years 5 to 10. It makes sense to include revenues from 5 to 10 years, as retention is relatively high, and even a small proportion of revenue beyond the 10 year horizon.

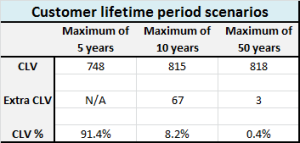

Let’s look at the same example, but this time using a 60% retention rate and a 15% discount rate. As you can see, the combined effect of these two factors virtually eliminates any real values stemming from longer term cash flows.

In this case, over 90% of the customer lifetime value is generated in the first five years. And even with a 60% retention rate, expected customer profits in the 5 to 10 year time period only add about 8% of value. At 60% retention, a firm should expect that some customers are still purchasing from the brand/firm in the 5 to 10 year horizon, so it is quite appropriate that some revenue is incorporated.

Why use a five-year cap on the customer lifetime period?

The counter argument provided as to why cash flows should not be considered past the five year horizon is because of the uncertainty of forecasting that far ahead in a dynamic environment. That is the role of the discount rate. If some of the numbers in the customer lifetime value calculation rely heavily upon assumptions, then it would be inappropriate to increase the discount rate in the calculation to compensate. That is, because they are possibly less reliable, the heavier discount rate will reduce their impact in the calculation – as demonstrated in the two tables on customer lifetime period scenarios.